Get In Touch

Have a question for Rylan? Want to run some numbers? Not sure what to do? Just need to brainstorm ideas? Reach out! Rylan will get in touch with you at the earliest convenience during the work week.

Call Rylan: 801-736-7746

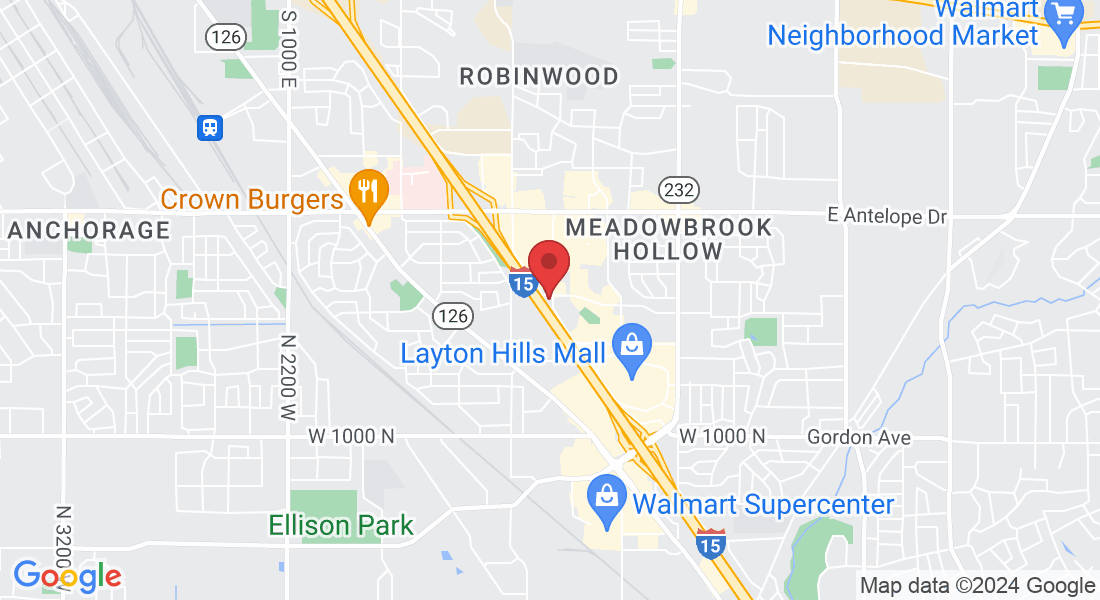

Office Directions: 1597 Woodland Park Drive #100, Layton, UT, USA

Email Rylan: [email protected]

Frequently Asked Questions

There's no such thing as a bad question!

What are the different types of home loans available?

There are several types of home loans available, including conventional loans, FHA loans, VA loans, and USDA loans. Each has its own eligibility criteria, down payment requirements, and benefits. We can discuss which option best suits your needs during our consultation.

What is the difference between pre-qualification and pre-approval?

Pre-qualification is an initial assessment of your financial situation to estimate how much you may be able to borrow. Pre-approval, on the other hand, involves a more thorough review of your finances by a lender, including verification of income, assets, and credit history. Pre-approval gives you a more accurate idea of the loan amount you qualify for and strengthens your offer when making an offer on a home.

How much of a down payment do I need to buy a home?

The down payment requirement varies depending on the type of loan you choose and your financial situation. Conventional loans typically require a down payment of 3% to 20% of the home's purchase price, while FHA loans may require as little as 3.5% down. VA loans and USDA loans offer 100% financing options for eligible borrowers. We can explore the options available to you based on your circumstances.

What is the difference between a fixed-rate and adjustable-rate mortgage (ARM)?

A fixed-rate mortgage has a constant interest rate and monthly payment throughout the life of the loan, providing predictability and stability. An adjustable-rate mortgage (ARM) has an interest rate that may change periodically based on market conditions, which can result in fluctuating monthly payments. We can discuss which type of mortgage aligns best with your financial goals and risk tolerance.

How long does the homebuying process typically take?

The homebuying process can vary depending on various factors such as market conditions, the complexity of the transaction, and individual circumstances. On average, it takes about 30 to 45 days to close on a home after the purchase agreement is signed. However, it's essential to be prepared for potential delays and work closely with your lender and real estate agent to navigate the process smoothly.

What documents do I need to apply for a home loan?

The documentation required for a home loan application typically includes proof of income (such as pay stubs or tax returns), asset statements (such as bank statements), employment verification, identification (such as a driver's license or passport), and information about any debts you owe. We'll guide you through the documentation process and help ensure you have everything you need for a smooth application process.

Start Your Home Financing Journey today!

© 2024 Primary Residential Mortgage, Inc. All Rights Reserved.

PRMI NMLS 3094. PRMI is an Equal Housing Lender. Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. Programs, rates, terms and conditions are subject to change and are subject to borrower(s) qualification. This is not a commitment to lend. The content in this website has not been approved, reviewed, sponsored or endorsed by any department or government agency.